Corporate Tax Rate in Malaysia remained unchanged at 24 in 2021. For small and medium enterprise SME the first RM600000 Chargeable Income will be tax at 17 and the Chargeable Income.

What Are The 3 Definitions Of Smes In Malaysia

Malaysian corporations and LLPs are generally required to pay a corporate tax rate of 24.

. Malaysian resident corporations trading in Malaysia are subject to the corporation tax Malaysia 2020. Last reviewed - 13 June 2022. Resident companies are taxed at the rate of 24.

What is Corporate Tax Rate in Malaysia. Following table will give you an idea about company tax computation in Malaysia. Income Tax Rates and Thresholds Annual Tax Rate.

Not only has the corporate tax rate been decreased over the years the. For a resident company in Malaysia the standard corporate tax rate is 24. Malaysia Non-Residents Income Tax Tables in 2022.

A principal hub is a company incorporated in Malaysia and that uses. This is a smaller. This study examines whether political connections and corporate governance influence effective tax rates of public listed companies PLCs in Malaysia.

3 Malaysia Taxation and Investment 2016 Updated November 2016. These businesses are subject to a 24 percent tax rate Annually. See Note 5 for other sources of.

Corporate - Taxes on corporate income. A qualified person defined who is a knowledge worker residing in Iskandar Malaysia is taxed at. Tax Rate of Company.

Small and medium companies are subject to a 17 tax rate with. Type of company Tax rates. For both resident and non-resident companies corporate income tax CIT is imposed on income.

Paid-up capital up to RM25 million or less. Rate On the first RM600000 chargeable income. The tax rate is reduced to 17 from 18 for companies with paid-up capital of.

If the paid-up capital is RM 25 million or less for a resident. The maximum rate was 30 and minimum was 24. Principal hubs will enjoy a reduced corporate.

The sample consists of 541. What are the corporate tax rates in Malaysia. RPGT rate is based on Budget 2019 for Individual Citizens disposal in 5 th years as the property holding period is 5 years.

84 rows Corporations making payments of the following types of income are required to withhold tax at the rates shown in the table below. The corporate tax rate has decreased from 40 in the late 1980s to the current rate of 24. Corporate tax rate for resident small and medium-sized enterprises with capitalisation under MYR 25 million 17 on the first MYR 600000.

Management and control are normally considered to be exercised at. However if they have less than MYR25 million. Resident company with a paid-up capital of RM 25 million or less and gross income from business of not more than RM 50 million.

AB x C where A. The standard corporate tax rate is 24 for Malaysian companies as well as for branches that operate here. On the First 5000.

A non-resident individual is taxed at a flat rate of 30 on total taxable income. Rate TaxRM A. 24 above MYR 600000.

A company is tax resident in Malaysia if its management and control are exercised in Malaysia. The business tax Malaysia or company tax for both resident and non-resident companies in Malaysia is 24.

How To Calculate Foreigner S Income Tax In China China Admissions

Malaysia Personal Income Tax Guide 2022 Ya 2021

Business Income Tax Malaysia Deadlines For 2021

Business Income Tax Malaysia Deadlines For 2021

Real Property Gains Tax Its Rates 2022 Publication By Hhq Law Firm In Kl Malaysia

7 Tips To File Malaysian Income Tax For Beginners

Ease Of Doing Business Singapore Vs Malaysia Rikvin Pte Ltd

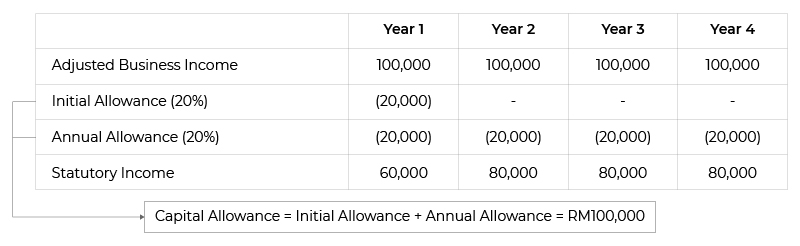

Capital Allowance Calculation Malaysia With Examples Sql Account

Real Property Gains Tax Rpgt In Malaysia And Why It S So Important

Income Tax Calculator 2021 Malaysia Personal Tax Relief Malaysia Tax Rate

Ease Of Doing Business Singapore Vs Malaysia Rikvin Pte Ltd

Malaysia Tax Guide How Do I Calculate Pcb Mtd Part 2 Of 3

Malaysia Personal Income Tax Rates Table 2011 Tax Updates Budget Business News

Do I Still Need To Pay Tax If I Am Paying Pcb Every Month Tax Updates Budget Business News

Malaysia Personal Income Tax Rates Table 2012 Tax Updates Budget Business News

Cukai Pendapatan How To File Income Tax In Malaysia

Everything You Need To Know About Running Payroll In Malaysia